More youthful chauffeurs commonly pay more for insurance policy coverage since they have less experience on the road and also are at greater risk of being associated with a mishap. When determining your premium, insurance provider take into consideration a couple of elements associated with your vehicle, such as the expense to fix it and general safety and security document. perks.

That's a great deal of cash. Of training course, the ordinary consumer isn't purchasing a new auto whenever they turn a web page on the schedule, so the auto's expense is amortized over the size of time you possess the auto. According to research study by R.L - car insured. Polk, the typical size of time motorists will certainly maintain a new lorry is 71.

91 additional each month. If, on the various other hand, you only have fair credit (620-659), you can expect an interest rate of around 13. 58% annually. It would bring your total costs as much as $13,894 in passion over 60 monthsan standard of $194. 59 per monthand $2,335 annually, for the lorry's lifetime.

91Annual Passion Price on a 60-Month Financing (Excellent Credit Report): $454. 92Monthly Passion Price on a 60-Month Finance (Fair Credit Scores): $194.

If you are in an auto crash, you will be in charge of the deductible to obtain your car repaired. If you do not have the correct protection for the crash handy, you will be in charge of the complete amount. trucks. Don't fail to remember about traffic infractions and also the costs that occur with them.

Some Known Details About Minority Neighborhoods Pay Higher Car Insurance Premiums ...

6 Ordinary Annual Expense of Automobile Insurance Policy: $1,592 Expense of Gas Gas rates are also very variable and also can transform from day to dayor from one side of the highway to the other. Presuming that an "ordinary year" is someplace in between, let's assume you can expect to pay around $2. Even extra vital than the cost of gas is the gas mileage of your certain car and also how much you drive in a provided month.

auto insurance insurance company vehicle trucks

auto insurance insurance company vehicle trucks

Taking public transit as well as making use of rideshare solutions like Uber or Lyft can be a huge expense conserving. Think about all of your alternatives and also the complete scope of the situation before going all-in on buying an auto.

Regular monthly cars and truck expenses are second only to housing expenses in a lot of home budget plans, however we have great news: There are a lot of reliable methods to decrease your cars and truck insurance policy premiums even as costs increase. Just beware: You'll intend to see to it you still have the protection you require. Maintain checking out for our tips on exactly how to reduce car insurance rates as well as just how much coverage actually costs.

Full insurance coverage consists of physical damages protection in addition to liability insurance coverage and medical insurance coverage (where required). Rates can differ by place and various other aspects, often dramatically. AAA's research study compiled average rates for chauffeurs that fit a certain profile, which brings some useful score variables. In the AAA research study, the insured vehicle drivers were: Under 65 years of age, Experienced vehicle drivers with over 6 years of driving history, Accident-free, Insuring a late model automobile, Let's take into consideration each of these rating factors to better comprehend just how rates might differ for vehicle drivers with different attributes.

What Does Average Us Car Insurance Costs By State For 2022 - Kelley ... Mean?

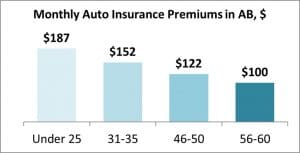

Some insurance firms enhance automobile insurance policy rates beginning at age 70 to 75. At the various other end of the spectrum, motorists under age 25 typically pay a lot more for protection. Driving Experience, Driving experience additionally contributes in rates. Some insurance firms won't guarantee a vehicle driver with much less than 3 years of experience unless they are added to the plan of an extra experienced driver.

Mishap Background, Your current accident background impacts insurance prices. If you have not had a recent crash, you can expect lower ratesassuming all other ranking elements are equal.

Area, Where you live can influence vehicle insurance policy rates. While there are frequently considerable differences in price from one state to the next, AAA's research study was based on vehicle drivers in urban as well as rural areas.

In this case, insurance companies are looking at website traffic thickness along with various other risks such as theft and also vandalism. However, rather than analyzing where you drive, insurance providers usually consider garaging area, with the assumption that a lot of your driving will certainly be close to where you park your car at evening.

Age as well as Worth of the Vehicle, In AAA's research study, the vehicle drivers guaranteed a 2021 model year auto. Occasionally security features readily available on newer vehicles can aid offset the price of insuring a more beneficial vehicle.

The 7-Second Trick For 15 Tips And Ideas For Cutting Car Insurance Costs - Investopedia

Many homes have lorries of numerous ages, occasionally with various insurance policy needs (insurance). As an example, if you have an older car that's settled, you could not require to lug physical damage insurance coverage. The National Organization of Insurance Policy Commissioners (NAIC) likewise puts out a record on automobile insurance prices, breaking out the price by state and also insurance kind.

Both insurance policy and insurance coverage offer defense for physical damages to your very own car. The premium refers to full insurance coverage, which includes needed liability coverage and also physical damages coverage. insurance.

Extra insurance providers are using usage-based price cuts. The innovation behind this is called telematics as well as makes use of an in-car tool to measure miles taken a trip, time of day, and various other driving metrics to compensate lower-risk drivers with money-saving price cuts (automobile). See all 6 photos, What Various other Factors Impact Auto Insurance Policy Rates? Car insurance policy rates think about even more than just your driving background.

Before you take a pruning shear to your policy limits, consider other variables that can affect your insurance prices. In the long run, your protection limits secure you and your family members, so greater limits can be a smarter selection for some. Below are some actionable variables that can impact auto insurance coverage prices.

cheap insurance cheaper auto insurance insurance company insurance company

cheap insurance cheaper auto insurance insurance company insurance company

If your credit rating could use a tune-up, taking actions to improve your credit report could bring about insurance coverage cost savings, as well. Relocating infractions can end up setting you back even more than just the price of the penalty. Tickets for moving offenses can trigger you to shed a risk-free driving discount rate and even cause a surcharge that can last for many years.

The Facts About How Much Is Car Insurance? - Liberty Mutual Uncovered

Before driving house in an auto you dropped in love with at the dealership, research study the price for insurance coverage. Often you'll gain better rates if you've had continuous coverage for three years or longer.

car auto accident liability

car auto accident liability

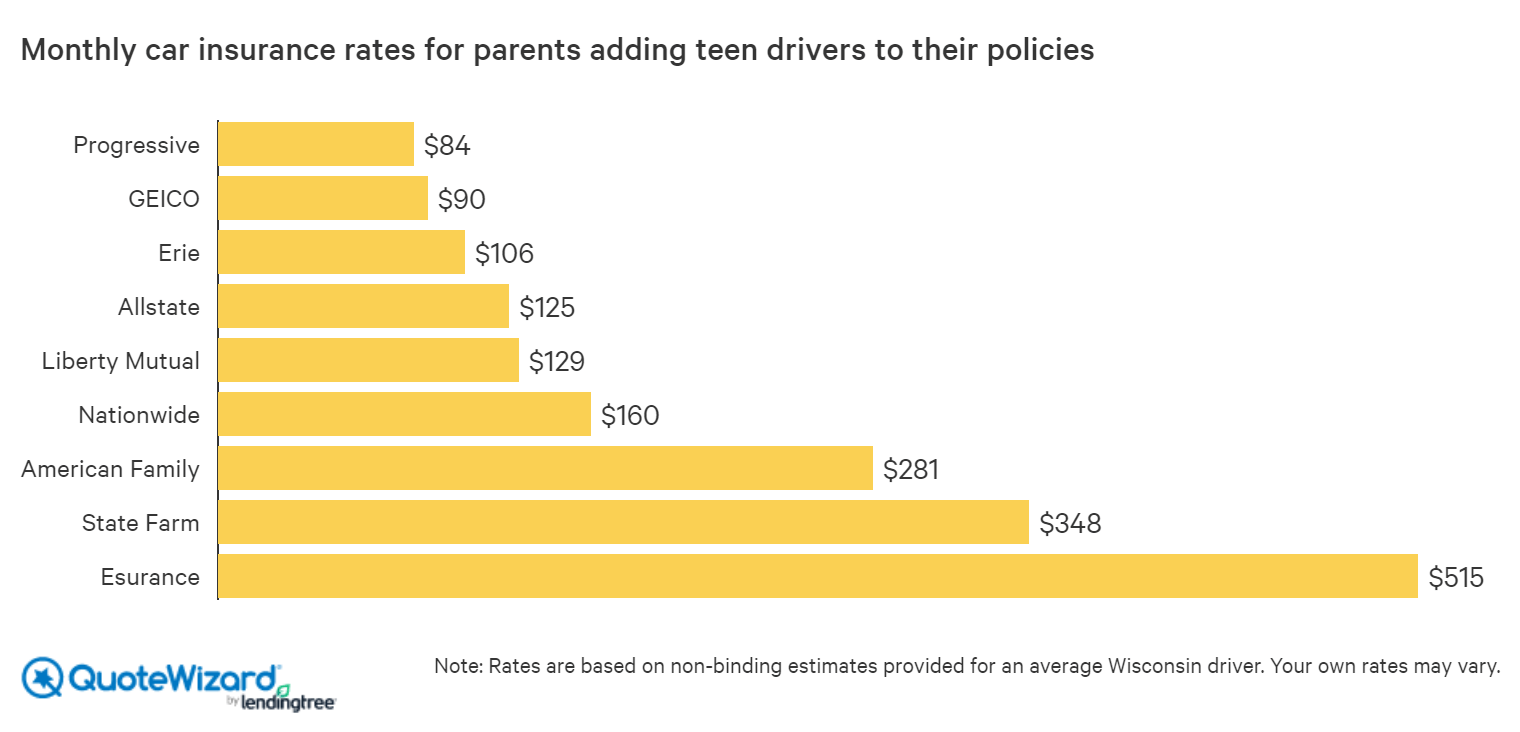

Take actions to make sure coverage doesn't lapse and also when transforming insurance firms do not cancel the old policy till after the reliable day as well as time for the new plan. See all Visit this site 6 pictures, Exactly how to Get Protection for a 16-Year-Old Driver, Car insurance coverage expenses can alter significantly if you have a young chauffeur in your home (car).

business insurance vehicle insurance auto insurance insured car

business insurance vehicle insurance auto insurance insured car

However, who has the automobile also plays a role. If you have the vehicle, the plan should remain in your name. If your teenager motorist has the vehicle, the insurance coverage requires to enter their name. If both names are on the title, you have some flexibility as well as can guarantee the car in either name.

Young drivers away at college can save on coverage if the auto stays residence and the institution is far enough away (normally 100 miles). Different from a chauffeur's education and learning price cut, lots of insurance firms also offer a discount for finishing an approved defensive driving course.

Many insurers now provide in-car devices that gauge rate, stopping, begins, cornering, and various other metrics that concern driving safety. In a lot of cases, you'll gain an instantaneous discount rate for participating with future price cuts based on risk-free driving - liability. Handling Auto Insurance Policy Costs, Vehicle insurance policy costs are among the most significant costs every month for several homes, yet there are numerous methods to save without compromising the coverage you need.

Average Monthly Car Loan Payments: Statistics - 2022 - Way Can Be Fun For Everyone

If you haven't assessed your insurance coverage lately, get to out to your insurance provider to discuss means to save. If you're buying new coverage, be sure to ask your new carrier which price cuts are available as well as just how you can qualify.