Your insurer will spend for your damages, minus your deductible, and after that ask the at-fault vehicle driver's insurer to pay the cash back in a process called subrogation - suvs.

While elevating your insurance deductible will certainly decrease your premium, there are various other effects to consider for your auto insurance coverage prices. Let's take an appearance at all the factors you should take into consideration when choosing your auto insurance policy deductible!

cheap car cheap auto insurance insurance affordable suvs

cheap car cheap auto insurance insurance affordable suvs

insurance insurance affordable car insurance cheap auto insurance

insurance insurance affordable car insurance cheap auto insurance

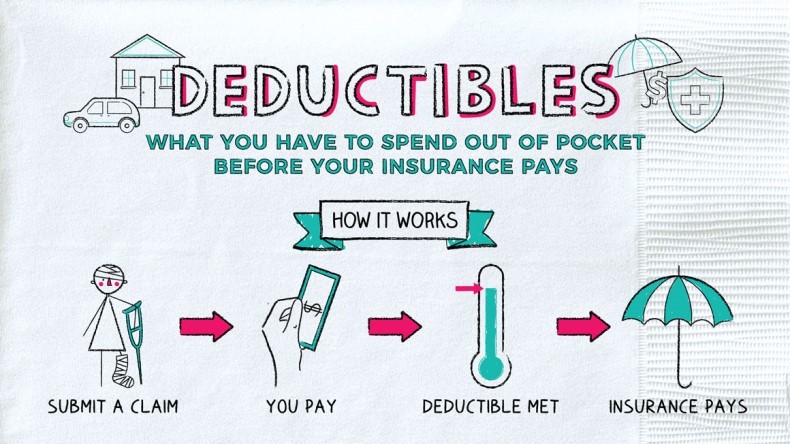

If you weren't required to have an insurance deductible, you can technically have as numerous crashes as you wanted on the insurance provider's cent. Paying an insurance deductible ensures you also have a stake in any type of cases you make. Deductibles normally only put on harm to your very own residential or commercial property, like in the instances of detailed and collision car insurance (low cost).

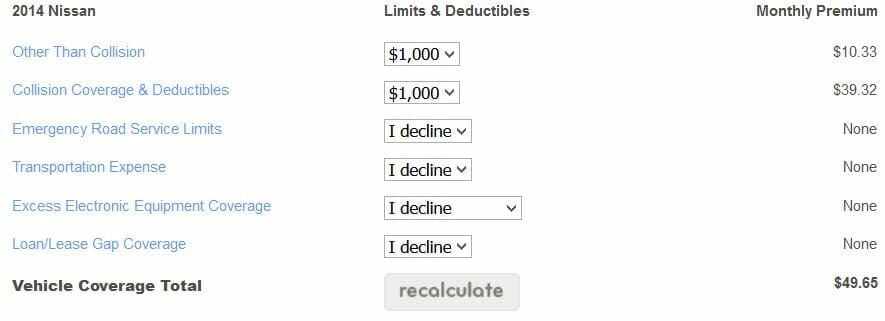

What is the relationship in between the deductible and premium? Frequently, a lower deductible ways greater regular monthly settlements. If you have a low insurance deductible, you have more protection from your insurance policy firm and also you need to pay less expense when it comes to a claim - affordable car insurance. A higher insurance deductible implies a reduced price in your insurance policy premium (accident).

A reduced insurance deductible of $500 implies your insurance company is covering you for $4,500. A higher deductible of $1,000 suggests your firm would certainly after that be covering you for only $4,000 - insurance company. Since a reduced deductible equates to more insurance coverage, you'll need to pay more in your regular monthly premiums to cancel this enhanced insurance coverage.

insurance insurance companies vans suvs

insurance insurance companies vans suvs

This was reliant upon the state, however, where Michigan just saved 4% for the deductible raise while Massachusetts conserved approximately 17%. However some people make the error of picking the greatest deductible just to conserve money on their premium. In the case of a case, however, having a high insurance deductible can have major economic consequences. cheap auto insurance.

The 25-Second Trick For What Is A Car Insurance Deductible? - Bankrate.com

If you have that cash accessible at any kind of point, it could be worth choosing a greater insurance deductible - car insurance. 2. What is the payback? Do the mathematics with your insurance representative. Just how much would certainly you conserve on a reduced costs if you had a greater insurance deductible? Would you save money that would certainly equate to that deductible in the case of an incident? Lets state that transforming from a $500 to $1,000 insurance deductible would certainly conserve you 10% on your annual premium.

Now you have an enhanced deductible by $500, however you are saving $80 annually. That indicates you would need just over 6 years in order to make up the distinction. If you don't enter a crash in those 6 years, the increased deductible was worth it. If not, you need to pay more out of pocket.

If you have a good driving document, a greater insurance deductible could function in your favor. car insurance. You'll save cash on the costs, which you can use in the direction of your insurance deductible when it comes to a claim. As an example, a driver who hasn't had an accident in twenty years might not be frightened by the above example of the 6-year time duration to comprise the distinction.

4. Exactly how risk averse are you? Inevitably, a greater deductible is a higher threat. The lower your deductible, the much more protection and also protection you have. Exactly how much are you as well as your family ready to risk? 5. What is the worth of your lorry? Pricey lorries set you back more to insure. In this case, a high deductible could make feeling since you would have greater cost savings on your premiums.

People that are renting or funding their car have a tendency to pick a reduced deductible. If you don't get in a whole lot of crashes, you can take the danger with a greater insurance deductible. To keep it basic, you might want to hold the same insurance deductible for all kinds of coverage as well as autos.

Not known Facts About What's A Deductible In Car Insurance? - American Family ...

There are other ways to decrease your costs, like looking around as well as bundling your car and also house insurance coverage. Go here to find out about the 16 ways to lower your car insurance premium. If you couldn't pay for to make your deductible tomorrow, you need a lower deductible. If you're an excellent motorist with a high resistance for risk, you can raise your deductible. auto.

As well as if you do not need to sue for 2, 3, or four years you can save a significant amount of cash gradually (liability). (FYI: the average automobile owner drives for 8. 3 years without sending an insurance claim. SUV as well as pickup owners have claims roughly every 6. 5 years).

Are there other means to conserve cash on insurance coverage? Other alternatives consist of added safety measures or house updates like an alarm system, an emergency generator, a brand-new roof covering, new electric or plumbing systems. As always, we such as to remind individuals that insurance coverage is an extremely individualized subject.

credit liability low cost car insurance

credit liability low cost car insurance

Allow's state you just got in a wreckage as well as your cars and truck requires $4,000 out of commission, but your insurance coverage will just cover $3,000. If you're confused, recognizing your vehicle insurance deductible could be the answer - car insurance. In this short article, we'll explain what a car insurance policy deductible really is, when you need to pay it, and also whether you must select a high or low one (cheaper car insurance).

You don't actually pay an insurance deductible to the insurance policy firm you pay it to the fixing shop when they repair your automobile. If you have a $500 insurance deductible, you must pay that amount before the insurance policy business pays the staying $1,500.

Insurers will certainly not be accountable for expenses that do not exceed your deductible. Your auto insurance policy deductible does not function like your medical insurance deductible. With health insurance, you have an insurance deductible that obtains reset each year. As you utilize health and wellness solutions, the cash you spend out of your very own pocket will include up.

The smart Trick of How To Choose Your Auto Insurance Deductibles - Rates.ca That Nobody is Discussing

When the new year rolls around, it all website starts over (cheapest car insurance). With vehicle insurance policy, you pay your deductible every single time you sue. Allow's say you got into a crash and also submitted an accident claim. On your way to the repair service shop, a freak hail storm includes more damages to your vehicle.