Whether you're a novice to the Golden State or you've lived right here for decades, you likely already recognize the legislation: Vehicle insurance is legitimately needed to drive in California (car insurance). (That need makes a great deal of sense, toocar insurance coverage is useful protection for every person when traveling, given that it helps make certain that no one obtains stuck to a massive responsibility costs after a mishap.)What you might not know, though, is that if you're a low-mileage driverespecially if you drive much less than 10,000 miles per yearyou might be able to save a lot on your automobile insurance plan with Metromile's pay-per-mile automobile insurance - cheaper.

You'll pay a rate that can be as reduced as 6 cents per mile you drive. Simply put, you'll pay for the miles you actually drive. On the months you drive much less, your costs will certainly be lowerit all makes good feeling! (Anxious regarding trip? Do not be. Metromile caps your daily mileage at 250 miles.)With Metromile, the much less you drive, the much more you can save.

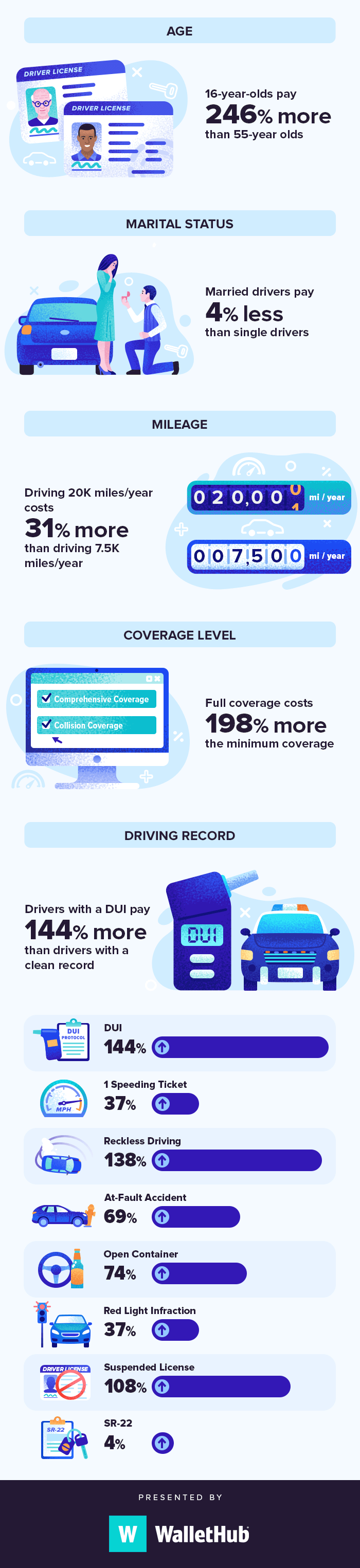

Insurance carriers want to see shown accountable habits, which is why web traffic crashes and also citations are aspects in figuring out automobile insurance prices. Aims on your certificate don't stay there permanently, yet just how long they stay on your driving document varies depending on the state you live in and the severity of the infraction - cheap car insurance.

A brand-new sports auto will likely be extra expensive than, say, a five-year-old car - auto insurance. If you select a lower insurance deductible, it will cause a higher insurance coverage costs that makes choosing a greater deductible appear like a respectable offer. Nevertheless, a higher insurance deductible could suggest paying more expense in case of a mishap.

cheapest car insurance auto cheaper car vans

cheapest car insurance auto cheaper car vans

What is the typical automobile insurance price? There are a variety of factors that influence exactly how much cars and truck insurance coverage expenses, which makes it tough to obtain an accurate idea of what the typical individual spends for car insurance. vans. According to the American Automobile Organization (AAA), the ordinary expense to insure a sedan in 2016 was $1222 a year, or roughly $102 monthly - cheapest.

The Single Strategy To Use For Cigna Official Site - Global Health Service Company

Nationwide not only supplies competitive prices, however also a range of discounts to aid our participants save even a lot more. Exactly how do I obtain cars and truck insurance policy? Obtaining a car insurance policy price quote from Nationwide has never been much easier. See our car insurance quote area and enter your zip code to start the auto insurance policy quote procedure - business insurance.

Vehicle insurance is necessary to shield you economically when behind the wheel. Whether you just have fundamental liability insurance policy or you have full auto coverage, it's important to ensure that you're obtaining the most effective deal feasible. Wondering exactly how to lower car insurance policy!. cheaper car.?.!? Here are 15 methods for minimizing automobile insurance prices.

perks affordable car insurance money car

perks affordable car insurance money car

cheaper cars insurance cheaper cars auto

cheaper cars insurance cheaper cars auto

Lower car insurance policy rates may additionally be readily available if you have various other insurance policy plans with the exact same firm. Cars and truck insurance policy prices are different for every motorist, depending on the state they live in, their choice of insurance policy business as well as the kind of coverage they have.

The numbers are fairly close together, suggesting that as you spending plan for a brand-new cars and truck purchase you may need to consist of $100 or two monthly for car insurance. Keep in mind While some points that impact car insurance policy prices-- such as your driving background-- are within your control others, costs might additionally be impacted by points like state laws as well as state mishap prices.

When you recognize how much is vehicle insurance coverage for you, you can put some or all of these tactics t work - car insurance. 1. Make The Most Of Multi-Car Discounts If you get a quote from an auto insurance policy company to insure a solitary vehicle, you may wind up with a higher quote per vehicle than if you asked concerning insuring numerous vehicle drivers or automobiles with that business - trucks.

How Faq Article source - California Low Cost Auto Insurance can Save You Time, Stress, and Money.

cheapest auto insurance car insurance insurance companies cheapest auto insurance

cheapest auto insurance car insurance insurance companies cheapest auto insurance

If your kid's qualities are a B average or above or if they rank in the top 20% of the class, you might be able to obtain a excellent student price cut on the protection, which typically lasts up until your youngster turns 25 - insurance companies. These discounts can vary from as little as 1% to as much as 39%, so be certain to show proof to your insurance coverage agent that your teen is a great pupil. insurance.

Allstate, for example, supplies a 10% automobile insurance discount rate and also a 25% house owners insurance policy discount rate when you bundle them together, so check to see if such discounts are readily available and also suitable. auto insurance. Pay Interest on the Roadway In other words, be a safe vehicle driver.

Travelers provides safe driver price cuts of between 10% as well as 23%, depending on your driving record. For those unaware, points are typically evaluated to a motorist for moving infractions, and extra factors can lead to greater insurance coverage premiums (all else being equal).

See to it to ask your agent/insurance company about this discount before you sign up for a class. auto. It's crucial that the effort being expended and the expense of the program translate into a huge adequate insurance savings. It's additionally important that the chauffeur enroll in an approved program.

risks money liability laws

risks money liability laws

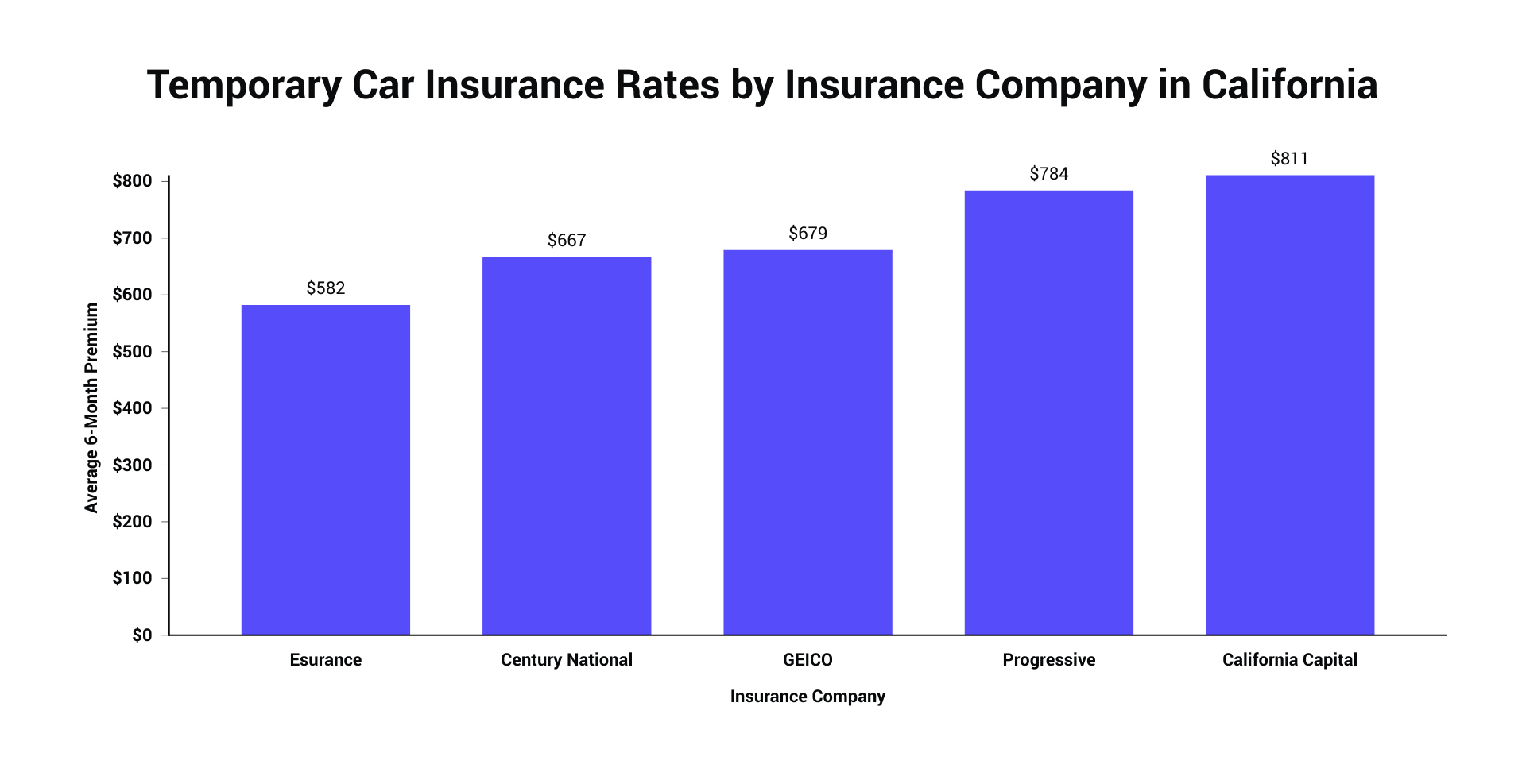

4. Look around for Better Auto Insurance Policy Fees If your plan is concerning to restore and also the annual premium has gone up markedly, think about looking around and acquiring quotes from competing business. Every year or 2 it possibly makes feeling to get quotes from various other companies, just in case there is a reduced price out there.